Dr. N.

How will the economic crisis consequent to the measures taken by governments during the dissemination of Coronavirus? The luxury watch market will he be involved? If so, how?

Let's find out in this article, where we will try to understand economic trends, the social context and how these could affect the two main values of the luxury market: watches and precious metals.

The economic context

The economic crisis caused by the measures put in place, especially in the West, during the spread of Coronavirus, disproportionately affected the working middle classes. In fact, the possibility of working remotely is not accessible to everyone. Those with a highly qualified, concept-based job do not encounter too much difficulty in adapting to work from home, rather than from an office: they used to interface with a computer before, they continue to do so now.

Problems arise instead when it comes to people who have less paid jobs - but no less useful, indeed: the world would go on without those who are writing these lines, but not without farmers who feed it… -. Many of these jobs, both in the primary and secondary sectors - think of farmers, breeders, cheesemakers, textile workers, welders, plumbers ... - and in the service sector - assist figures such as assistants to the elderly and the disabled, governesses for children, retailers, restaurant operators… - they do not have the physical possibility of being carried out from home. Like it or not, most of theeconomy of a developed country relies on middle-class consumption.

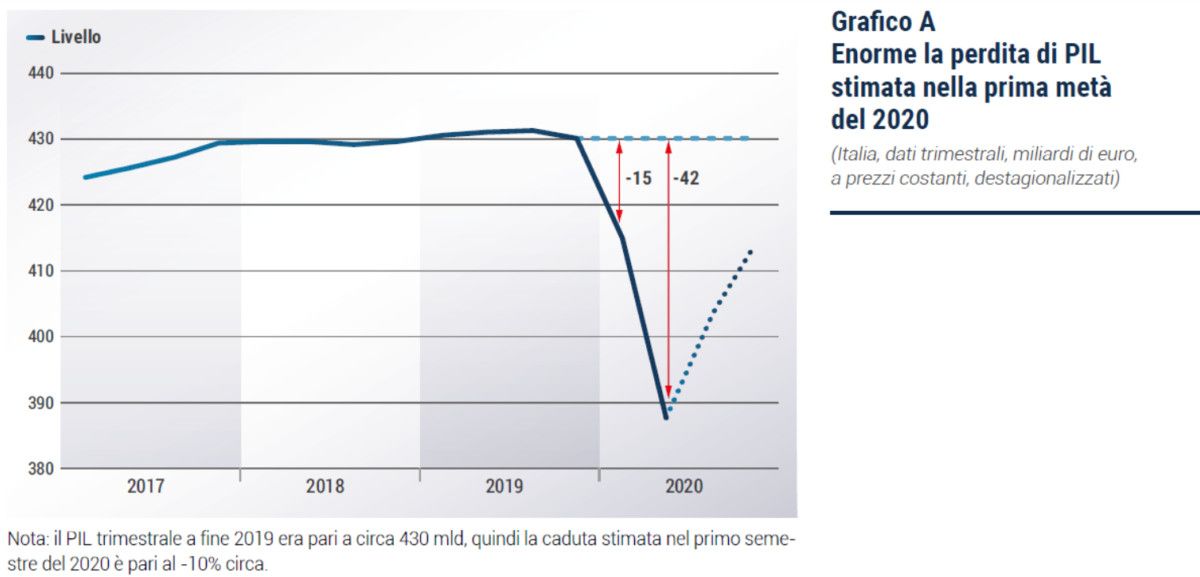

So what happens when the middle class, due to a lack of income perception, contracts consumption? The whole economy slows down, in a self-sustaining spiral that mainly involves those who live off the retail trade and medium and small producers, who do not have the possibility to seek foreign markets. In other words, the middle class is the hardest hit both from the initial phase of this crisis and its consequences.

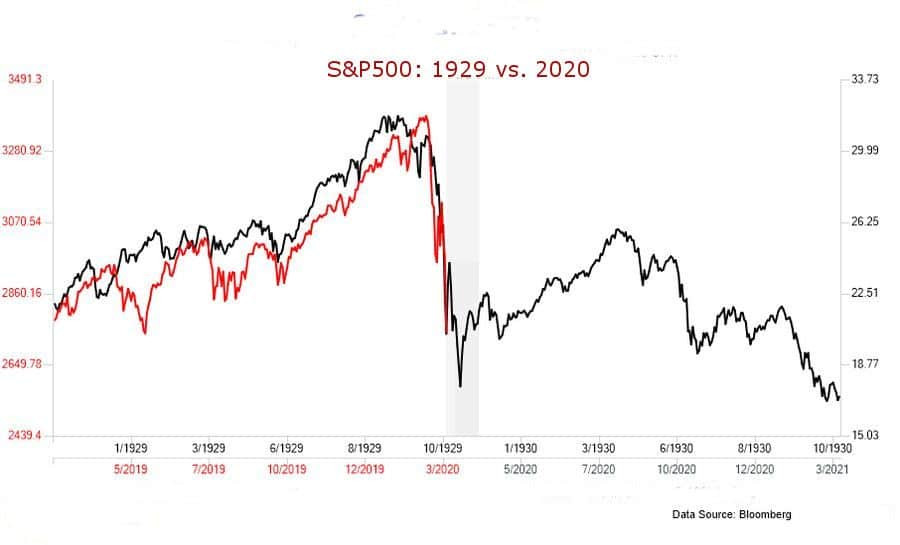

The fall of the American S&P index, although indicative of stock prices, gives us an idea of the parallelism between the crisis of 1929 and that of today

The consequences of the crisis on great wealth

Let us now see what consequences the crisis can have on great wealth. We take care of it because these are the subjects that most move the luxury market

Logically, there are two possible scenarios: today we will see the first, the most "optimistic" one, ie the one in which the middle class, hit by the crisis, is rescued by state authorities in order to preserve their standard of living.

Let us therefore assume a series of Keynesian stimuli aimed at ensuring full employment. This hypothesis is based on what happened in the past after the 1929 crisis, the only one comparable in impact to the present one. Deficit public spending policies aimed at generating full employment led to some inflation once the aforementioned full employment was reached.

If this picture were repeated, we would be faced with a situation in which the middle class would see its purchasing power be shared thanks to the wages resulting from the full employment, while the upper classes would see their savings put at risk due toinflation: the solution that the upper classes would resort to to safeguard them would presumably be to buy assets capable of acting as a store of value. Gold, luxury watches and real estate valuable could be some of the purchase objectives for those who have savings and want to protect them from inflation.

Confindustria data on the collapse of Italian GDP following the crisis

So what would happen on the watch market?

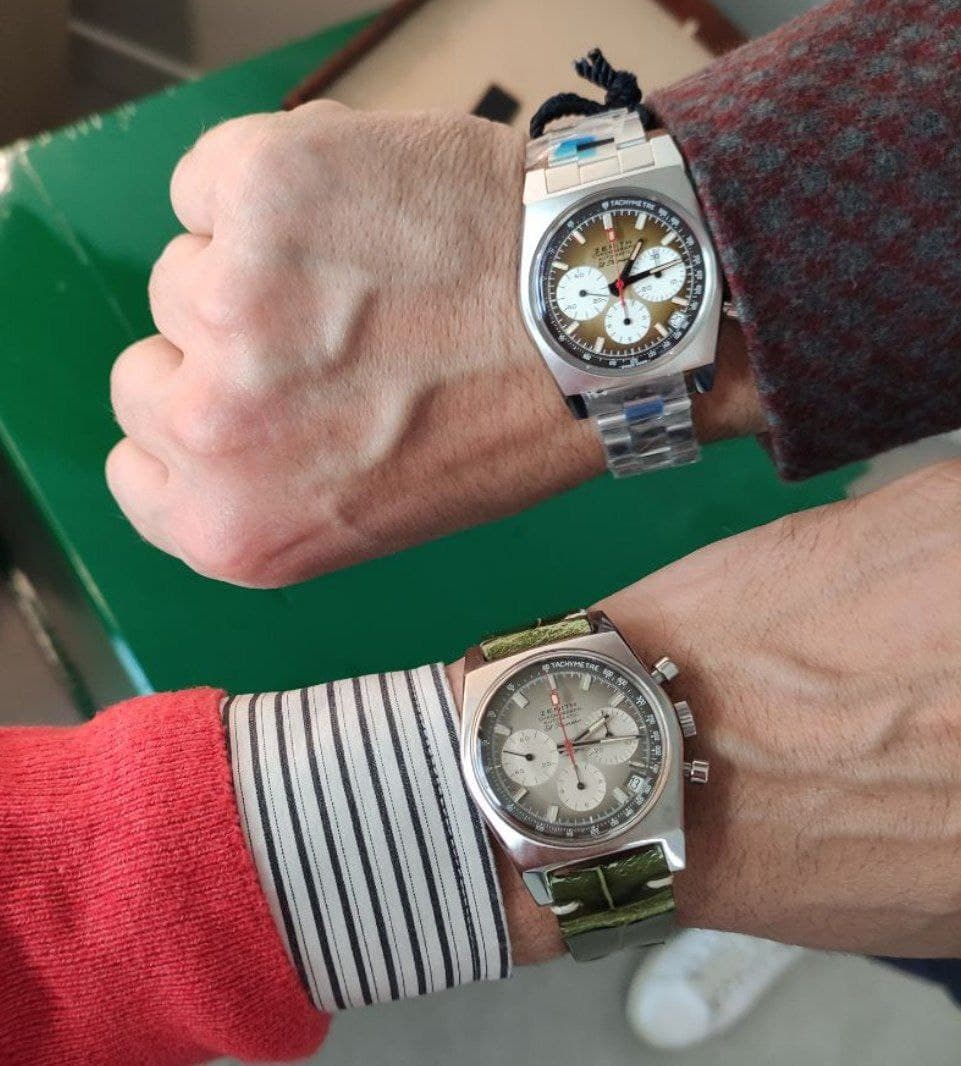

In the "Keynesian" case analyzed above, what would happen to the watch market would recall the years of the First Republic. The widespread diffusion of wealth would lead to a significant stimulus to the well-being of the middle class, which would also invest its new income in consumer discretionary goods such as the mid- and low-middle-range luxury watch. Brands such as Longines, Tudor or Cartier would benefit.

Also the high end of the watch marketo it would be affected by an increase in demand, not so much because of the increased demand from middle-class subjects, but because of the supervening need of the upper classes to safeguard their savings from inflation. An economic system such as that envisaged by our Constitution - suffice it to see article 3, co 2 - provides for full employment, which is intrinsically a cause of inflation. Without broadening the discussion too much, we can say that the alternative is between a strong currency and widespread well-being: they cannot be had together. In this article we have seen the constitutionally oriented economic hypothesis, in which the State intervenes to bring about full employment as happened in the First Republic. It is a political choice to favor widespread well-being to the detriment of the protection of those who hold great wealth. A choice that would be constitutionally obligatory, but nothing is taken for granted, on the contrary: analyzing what has happened in the last three decades, we believe a second hypothesis more likely.

So what is this mysterious second hypothesis? Follow us in the next article to find out!

If you liked this article, subscribe to the Chronosect Newsletter (at the bottom of the home page) and read our Shops!

Disclaimer

This article is written for informational purposes only and is not intended to provide financial or investment advice. Always contact competent subjects for your investments. We decline any responsibility for the investment advice that the reader may wish to draw from this article. The information contained herein should not be considered a solicitation to the public for savings or the promotion of any form of investment, nor personalized recommendations pursuant to the Consolidated Law on Finance, since it is only standardized information addressed to the indistinct public.