Dr. N.

The time of crisis - Clocks as a safe haven

The advent of the coronavirus pandemic has prompted a wave of panic in the financial markets. Between February 30 and March XNUMX, the Dow Jones, an index that measures the performance of XNUMX major listed companies in the US, lost over a third of its value. The FTSE MIB, which measures the performance of the Italian stock exchange, fell by forty percent in the same period.

Does this mean that the American economy contracted by thirty percent in a month, and the Italian economy by forty percent? No.

Those who buy shares do so with the expectation of being able to resell them at a higher price. When a negative event occurs, such as a reduction in production due to a sudden increase in the price of oil as in 1973, or, as in our case, an epidemic that slows down or stops several sectors of economic life, it is normal for those who hold shares to be panicked and suddenly give up. Not only because the companies that issued the shares lose, in perspective, the ability to generate income - and therefore dividends -, but above all because all the other holders of shares are expected to sell, and we try to sell before the others, to limit losses.

So a collapse of the financial markets is a problem, even a serious one, but it does not imply the collapse of an entire economy. Nor does it necessarily involve all non-financial assets.

The safe haven goods

So-called safe havens are a series of tangible and tangible assets that tend to retain their value in times of crisis.

They are divided into real estate and movable property.

The first category includes houses and land: popular wisdom recalls that "the land is not manufactured", and is therefore not subject to inflation. However, real estate can lose part of its value, as happened when the Monti government imposed a property tax (the IMU note) on Italian real estate to finance the European States Save Fund. This led to a drop in the Italian property price: in fact, an asset that is subject to taxation becomes less attractive, being to some extent comparable to a property with a negative return.

Money

Turning to movable assets, the first that comes to mind when it comes to wealth is liquidity, cash, so much so that it is often considered synonymous with wealth itself.

Advantages of cash:

- It can be immediately used to purchase goods and services of all kinds, in Italy and abroad.

- It allows you to diversify, choosing to invest both in local currency and in foreign currencies.

Disadvantages:

- The currency is subject to the risk of renaming in the event of leaving the euro, a hypothesis that is no longer as remote as it once was. This problem affects both cash and what is held in the current account.

- The temptations of the policy of restricting the limit on the use of cash make it easier to use significant quantities of currency, if it is physically held in the form of paper money.

- The increasingly current risk of capital withdrawals from current accounts or banks' difficulties does not make savings completely secure. From a legal point of view, the money deposited in the bank is owned by the bank, which undertakes to pay its equivalent to the account holder: with the regulation bail-inaccount holders with more than € 100.000 in their account may be affected by the lending crisis.

- Inflation risk is always present, to varying degrees depending on the currencies.

Luxury goods

In addition to cash, movable wealth has always been preserved in the form of so-called luxury goods.

Among these, we can distinguish between:

- Gold and gems

- Watches and jewelry

- Other assets

Gold and gems

Gold and gems are objects found in nature which, given their natural scarcity and the attractiveness of many buyers, have long been the role of safe haven properties since time immemorial.

The gems are characterized by a remarkable differentiation in types, and are not as easily resellable as gold; on the other hand, they allow - especially diamonds - to store value in extremely small spaces.

Gold has always been the reserve of value par excellence. The central banks themselves retain large quantities of wealth in a golden form, with the aim of guaranteeing the stability of the currencies they issue. This desirability, however, has made gold the object of speculation, so much so that it is very difficult to say whether gold is below or overvalued compared to its real value. Between summer and winter of 2019, gold went from 35 to 45 euros per gram, so it could be said that it is now overrated; but it is also true that, if we compare it with the huge money supply created by nothing from central banks in the last two-three decades (we are talking about trillions, or thousands of billions), we could argue the opposite, namely that gold hasn't grown enough compared to paper money...

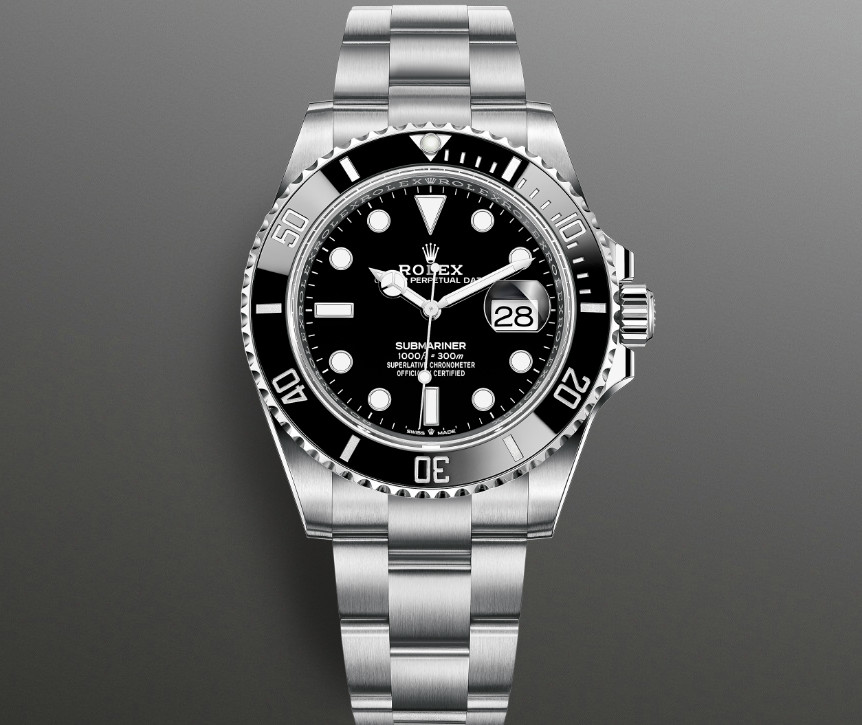

Watches and jewelry

Watches and jewelery have established themselves as safe havens over the past century.

The price of the jewels depends on the refinement of the workmanship, not only on the quantity and quality of the precious material used: this makes them a more compact and discreet means of conserving the value of gold and gems, but less easy to resell.

Although they cannot boast the "longevity" of gold or diamonds as safe havens, watches are probably one of the most interesting savings instruments on the market.

The advantages of the watches are obvious:

- They attract less attention than cash or gold. A watch allows you to carry, under the cuff of a shirt, tens or hundreds of thousands of euros, without being noticed by the bad guys: some brands are more known than others, but already passing, for example, from a Rolex to an Audemars Piguet allows to store value with much more discretion.

- Except for a few temporary spillovers in times of crisis, spillovers that are recovered in a few months, an asset that retains its value well. Indeed, in the case of the most prestigious brands (Patek Philippe, Audemars Piguet, Rolex and others) the value increases over time.

It is advisable to contact expert subjects to purchase a valuable watch. In addition to the obvious risk of fakes, which also involves other forms of safe-haven assets (think of diamonds), it is important to take precautions by purchasing a watch that guarantees to maintain, and possibly increase, its value over time. If you decide to go to the vintage, which especially with the maison more prestigious it is sometimes even more exclusive than the new one - there are highly demanded watches, now out of production for a long time, the number of which therefore cannot increase -, it should be remembered that only a qualified seller can help to carefully evaluate the conditions of keeping the clock.

The prices of watches: the example of Rolex

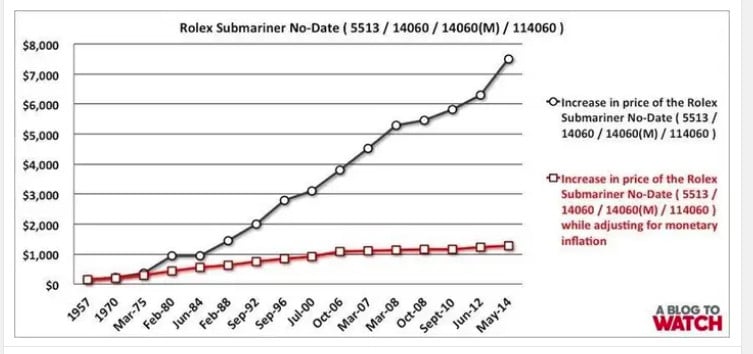

The Business Insider site, using the A Blog To Watch site and the Atelier de Griff site as its source, show two interesting graphs, which show the price trend of Rolex in the last decades.

The first of these graphs shows us the price of the Rolex Submariner undated, in its various versions that have followed over time (5513, 14060 and 114060).

The price marked by the black line is the nominal one, measured in US dollars (source: a blog to watch)

The price indicated by the red line is always in US dollars, but without inflation. It can be seen that its growth is much more gradual and moderate.

These graphs indicate that the undated Rolex Submariner, a classic of the House founded by Hans Wilsdorf, has retained its value by beating inflation, and in addition to this, it has increased it over time, at a moderate but constant pace.

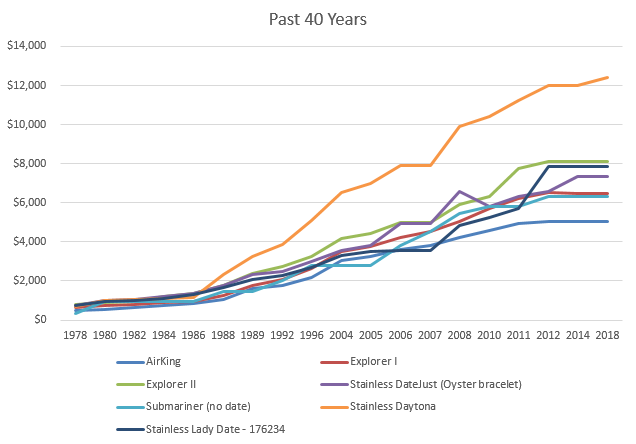

The second chart, which is not adjusted for inflation, shows the price trend - always in dollars - of various Rolex models. It immediately catches the eye as the model that has increased its prices among those considered to be the most Daytona in steel.

Conclusions

A prudent investor should always diversify, to be sure that his savings are not compromised by a single wrong investment. The most reasonable solution appears to be to invest one's savings in assets that historically retain their value: at least one residential property, some liquidity for ordinary expenses, and then a balanced portfolio of gold and prestigious watches. In this way, you can protect your assets from crises.

A final consideration: the present crisis induced by Coronavirus is a crisis of production, on the supply side, and consumption, on the demand side. Factories don't produce, and consumers have no income. It is therefore reasonable to expect measures to support income on the one hand, and to support production - subsidies, nationalizations - on the other. Both of these policies introduce significant amounts of liquidity into the economy, presumably leading to some form of inflation - especially when, once the crisis is over, wages start to rise due to the aforementioned income support, and the Keynesian full employment policies that occur. will make it necessary -. The shrewd investor will therefore look around during this acute crisis, seeking to buy safe haven assets at affordable prices, thereby shielding their money from likely inflation to come.

It would also be a good idea to evaluate the difference between list prices and actual watch prices. Especially in the Rolex area, there has recently been a rise in the price of some models above the list prices: with this crisis, the two prices are likely to realign, offering interesting opportunities. Let's not forget that the engine of price growth in recent years has been China, and that the Asian giant is already leaving behind the most acute phase of the influence: it is reasonable to assume that it will return to buy, raising prices, in the next times.

Disclaimer

This article is written for informational purposes only and is not intended to provide financial or investment advice. Always contact competent subjects for your investments. We decline any responsibility for the investment advice that the reader may wish to draw from this article. The information contained herein should not be considered a solicitation to the public for savings or the promotion of any form of investment, nor personalized recommendations pursuant to the Consolidated Law on Finance, since it is only standardized information addressed to the indistinct public.