Dr. N.

For many, the prices of luxury watches are unaffordable. Many others would say that, even with substantial sums available, it would not be worth investing in a non-essential item such as a watch. Still others fear the loss of value due to wearing the watch on their wrist and prefer not to spend significant sums on an asset subject to depreciation.

Let's see together what are the main economic evaluations that are right to carry out before taking an important step such as purchasing a luxury watch.

What does the clock mean to me?

The first question to ask is: because I want to buy a luxury watch? The reasons are many. If the prevailing one is personal pleasure, the desire to indulge in a timepiece that one has always wanted to own, the desire to wear the object of desire on the wrist, then it is not necessary to talk about calculations: if the purchase of the watch does not involve financial difficulties, buying it and enjoying it is the right choice.

If, however, the watch is also purchased as an investment, then it is appropriate to analyze some issues in more depth.

Is the price of this watch too high for me?

If you decide to buy a watch as an investment, especially if the price is important, you cannot help but ask yourself, without any inferiority complex, an essential question, namely: How much can I afford to spend on a watch?

The answer must be given by considering not only and not so much your current liquidity, but the serenity in purchasing the watch: if shelling out that sum of money involves a risk for your financial position, it is better to postpone it until better times.

The amount that can be spent on a watch is therefore subjective: it depends only on the individual buyer. No watch, therefore, is "too expensive" or "really convenient": it depends on how much you can spend without impacting your peace of mind..

Is the watch I chose a good investment?

Once you are sure that the expense - be it absolutely high or modest - does not impact your economic security, it is time to ask yourself: is investing that sum of money in that particular wristwatch a good idea?

The answer cannot fail to take into account the value retention of the timepiece. Especially when it comes to demanding figures, it is necessary to consider the presumable future trend of the price of the watch. There are many factors to consider:

- Some brands depreciate less than others

- Some models, within the most popular brands, have different devaluations from the rest of the range

- Watches produced in limited series generally depreciate less

- Most of the devaluation occurs in the first months and years after purchase. The watches vintage tend to stabilize their value

- Within the vintage, some particularly popular models not only do not depreciate, but tend to acquire value over time.

Watches from houses such as Patek Philippe, Rolex and, depending on the individual models, Audemars Piguet and Omega, generally depreciate less, or even revalue, compared to watches that are perhaps of high quality but produced by less famous houses.

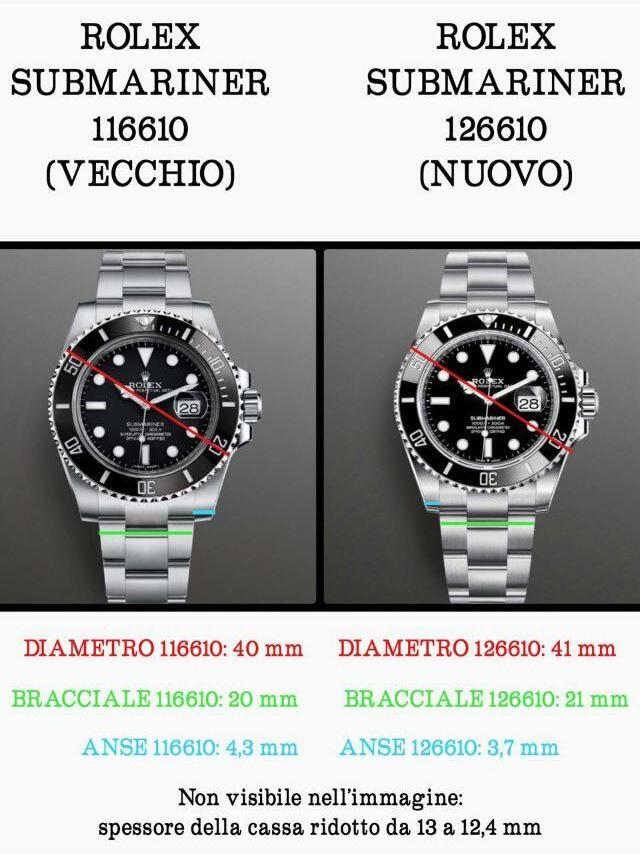

Some models from the most popular brands depreciate less than others. For example, within the Omega range, the Speedmaster holds its value better than the Railmaster. The same goes for Rolex: steel sports watches are so popular that they are currently only available on the market at a lower price. top to the price list.

Il vintage then, it really is a world unto itself. There are models, like the Rolex Daytona 6241 “Paul Newman”, faced initial public disinterest and “exploded” in the ratings many years after their launch. Others, like the Rolex Submariner reference 6538, which "started off on the right foot" immediately, being appreciated also thanks to the image conveyed by the actor Sean Connery, who wears this very watch playing James Bond 007.

Finally, there are models which, at reasonable prices, allow the enthusiast to wear real pieces of watchmaking history on their wrist: we speak to example of Zenith El Primero, which can be found used at relatively low prices. In fact, a Primero chronograph costs between a quarter and a fifth of a Rolex Daytona 16520 equipped with a movement of Zenith origin, without the intrinsic quality of one being inferior to the other, on the contrary: the Zenith also offers the date complication.

Watches as an investment: is it worth it?

We have seen how the issue of investing in watches is complex and multifaceted. Even if we want to be rational, then, it is almost impossible to ignore the passionate element: if you like a watch, and the purchase does not create budget difficulties, why deny yourself it?

If it is then possible to combine passion with value retention, choosing a brand and a watch model whose depreciation is limited or which even does not depreciate over time, then the ideal balance between heart and head has been found.