Dr. N.

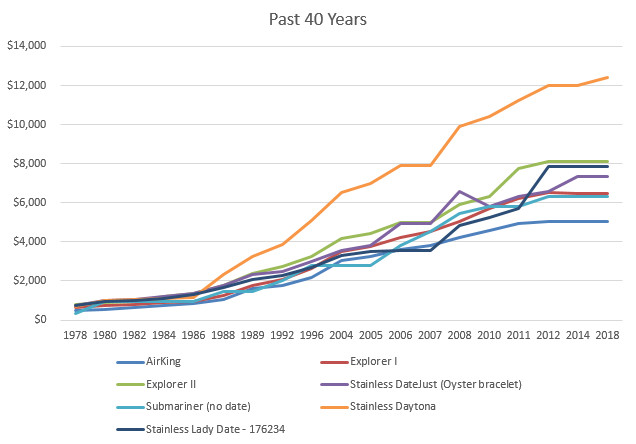

The crisis following the spread of Coronavirus has created uncertainty in consumers. Many wonder if at the moment a Rolex is still a valid choice for invest your savings. In this article we will see why the answer is yes: i Rolex they are still, and likely to remain for the foreseeable future, watches capable of keep its value over time, as evidenced by the fact that during the Coronavirus crisis i Rolex prices remained unchanged.

The Coronavirus crisis and Rolex prices

Let's start by saying that Rolex prices have remained essentially unchanged throughout the Coronavirus crisis. This is due both to a question of stable demand and to a non-expansion of the offer, as explained in the paragraphs below.

There are also reasons to be optimistic about the future. The savings rate of households in the US is rising sharply, thanks to the stimulus of the Fed wanted by Trump. As for the European continent, the EU has not yet published the data for the first quarter, but, as the monetary stimulus reaches savers, as will certainly happen in Germany and France, it is reasonable to expect an increase in the saving rate. also in the Eurozone.

Why is the savings rate important? Because in the current environment, interest rates are now negative. The presence of liquidity in the current account and negative interest rates stimulates savers to look for suitable instruments to preserve the value of their money. The real estate market, traditionally a destination for liquidity especially in Italy, will not necessarily be able to provide an outlet: the high unemployment rates, in fact, make it difficult to obtain an income by renting a property, not to mention that the fear of an asset on the properties themselves it will act as a further brake on investments in the sector. The bond market could be a way to vent liquidity, but yields today are low and set to fall. The gold market, even if it shows an upward trend, is unpredictable, as the trend during the Coronavirus shows: many experts expected to see it rise higher than the € 50 per gram it reached after an initial rise.

It is therefore likely that Rolex prices, seen by many as an investment, will not drop too much. The Chinese recovery will probably also count: the Asian giant was the first to be affected by the Coronavirus, and the first to get out of it. The decline in Chinese GDP in the first three months of the year was 6.8%, which is not excessive considering the gravity of the situation. Analysts expect that the Country of the Dragon, in 2020, will grow by 1.8%: we remember that it is still the epicenter of the pandemic, and that the fact that growth is expected overall for the current year, bodes well for the future.

Rolex: the question

We must also not forget that the structure of wealth in the world today is very different from what it appeared a few decades ago. The middle classes are those that have suffered the most from the economic contraction of 2008, never really managing to recover their previous well-being: the coronavirus was just the umpteenth blow, which further aggravated the situation, already compromised by the substantial end, recorded since the nineties, of the social pact which in the post-war period had guaranteed the welfare of the masses.

As cynical as this may seem, the Rolex has long been no longer an upper-middle-class watch, but a status symbol of the upper classes. The latter are those that have benefited most from the economic growth of the last thirty years. The upper classes are the closest to the world of finance, and presumably they will benefit from most of the coming monetary stimulus, especially in the EU area. Some form of assistance will perhaps be provided for those who are worse off, but the greater part of future growth, if what has happened in the past decades teaches us a lesson, will concentrate on the wealth of the wealthiest. Proof of this is that, in the United States, the already billionaires saw their wealth increase by 10% during the pandemic. It is therefore from this vision of reality, supported by a cold observation of economic facts, that we must start to formulate hypotheses on the evolution of Rolex prices.

Rolex: the offer

The other side of the price equation, after demand, is of course supply. This aspect is actually the easiest to analyze, in the case of Rolex, as it does not concern a myriad of buyers with unpredictable behavior, but a single production reality. The past behavior of Rolex shows us a very clear path: the choice to produce fewer watches than the market requires, in order to preserve the exclusivity of the product, was pursued by Rolex even when it would have had economic advantage to do otherwise. I'm talking about the production cut decided in 2018, when the market was also booming and the demand was extremely strong. Increasing production would then have led to an increase in revenues for Rolex without particular negative effects on the perceived exclusivity of its watches, as production would have been absorbed by the market anyway. We can reasonably assume that the present crisis will also be addressed by Rolex by looking at the long term and avoiding debasing its brand by producing more than the market requires. If this means keeping the watches produced in stock - a rather extreme hypothesis - it would not be a big problem for Rolex. The company has amassed large profit margins in the past, and has the cash to deal with any emergencies. Furthermore, since the company is not listed on the stock exchange, it does not have to face the pressure of shareholders to distribute profits or to raise the value of its shares: Rolex can pursue, as a company, the industrial policy it sees fit. The industrial policy chosen by Rolex Is that of preserve the brand value: and there is no reason why this should change.

Rolex prices: conclusions

The picture traced therefore suggests that i Rolex prices in the near future they will not decrease, on the contrary: i Rolex continue to be seen as a safe investment, both for the strong interest they arouse as a product in the most diverse markets, and for the manufacturer's policy of keeping production volumes low.

Un Rolex watch, new or used, therefore, continues to appear as a valid way to invest its savings, as it has been so far, despite the Coronavirus.

Disclaimer

This article is written for informational purposes only and is not intended to provide financial or investment advice. Always contact competent subjects for your investments. We decline any responsibility for the investment advice that the reader may wish to draw from this article. The information contained herein should not be considered a solicitation to the public for savings or the promotion of any form of investment, nor personalized recommendations pursuant to the Consolidated Law on Finance, since it is only standardized information addressed to the indistinct public.