Over the past two years, i shelter goods they have been increasingly the object of interest on the part of savers. Real estate and fittings, gold watches di luxury… But who had the best performance? And who offers the best prospects of investment for the future? Let's find out in this article.

Gold and silver

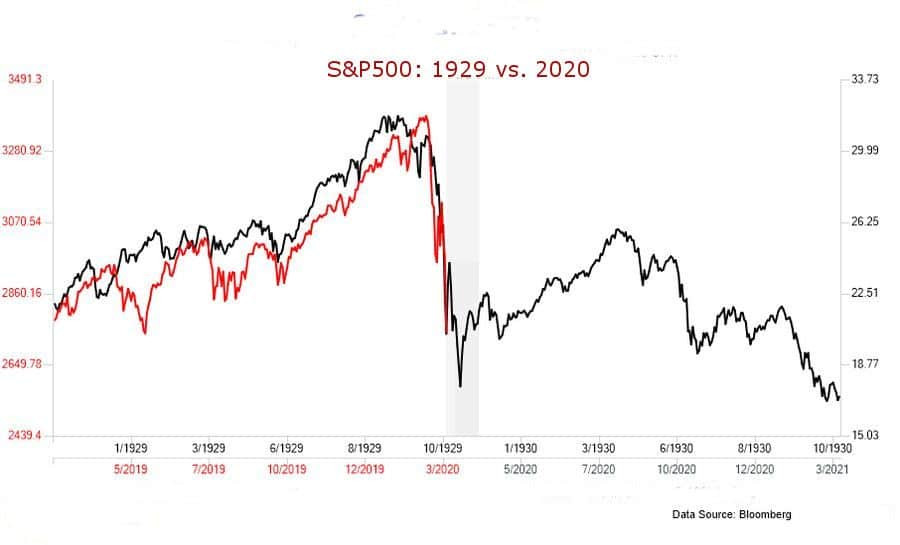

The two most popular precious metals have both seen their prices rise over the past two years. Let's start fromsilver: although fluctuating, it has undergone an overall revaluation, from fifty cents per gram two years ago to about seventy today.

Also 'gold has increased in value. It is true that it is a metal whose price is influenced by many variables, often of a political nature, but one cannot avoid noticing an upward trend. At the beginning of 2020, the precious yellow metal was quoted at around forty-five euros per gram, today it is around fifty-seven.

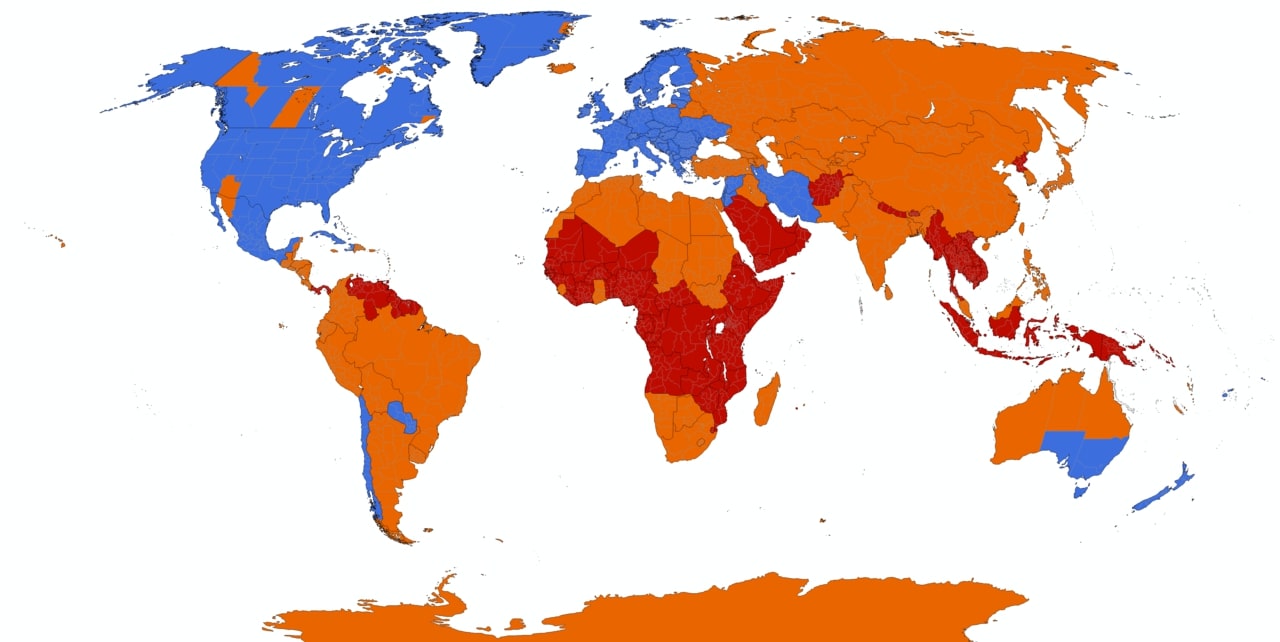

Real estate

The properties have seen their value remain substantially unchanged over the last two years. However, the gap between luxury and the average level has increased: while the prices of common properties have fallen, those in high energy class and with fine finishes are increasingly expensive. Even rents - properties have the interesting characteristic of being, unlike other safe-haven assets, naturally interest-bearing - have adjusted upwards in prestigious buildings.

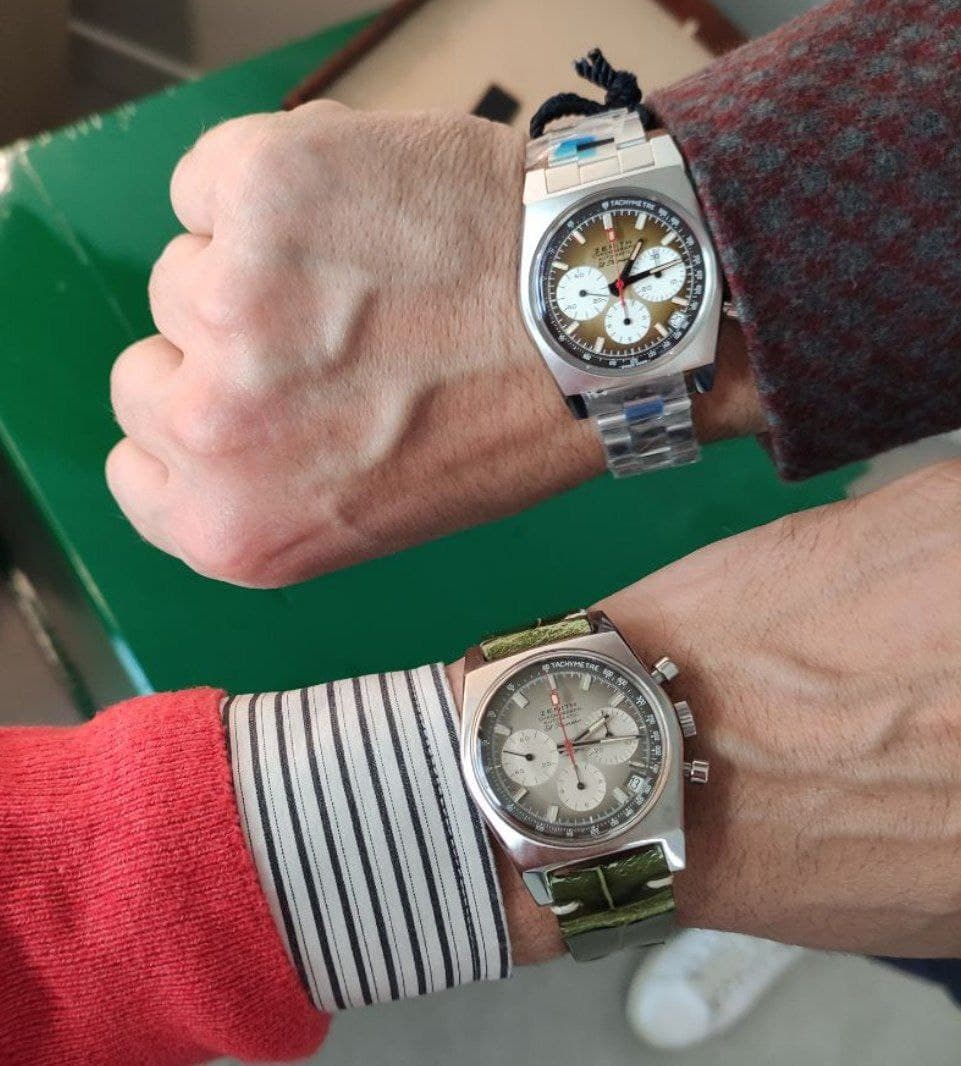

Luxury watches

In the watchmaking sector, the last two years have seen above all suffering timepieces di luxury of medium level, those in the range up to five thousand euros. On the other hand, first-rate watches, under one thousand euros, were only partially affected by the general economic contraction. The Segment over five thousand euros then it saw excellent performance, with very notable peaks for certain brands and models.

Rolex and its sportsmen are on everyone's lips: GMT, Submariner, Daytona today they cost even a third more than what they quoted at the end of 2021. Considering that the prices were already above the list then, it is understandable that those who have invested in these watches can now boast a considerable profit.

Also Patek Philippe has seen large increases in the prices of its sportsmen - Nautilus e Aquanaut primarily -. Same trend for Audemars Piguet, with the Royal Oak more and more requested and difficult to find, even in the version offshore.

In the next piece we will find out how to make the most of the rises in the watch industry for investment purposes. In the meantime, remember to subscribe to the Chronosect not to miss even an article from our magazine!