The question many are asking is how invest their savings to protect them from inflation. La crisis economic consequent to the government measures launched in the Covid era has been added to a contraction of the offer caused by the Russian-Ukrainian conflict.

So let's see which ones securities investments are more interesting between gold, cryptocurrencies and luxury watches, to get an idea of how to protect your savings in times of economic crisis.

Gold

The yellow metal has always been the store of value par excellence. It has many advantages, such as easy divisibility, the possibility of backlog gradual over time, the immediate resalability as needed.

- disadvantages of gold they are few, among these there is certainly his recent one inflation which makes it difficult for those who want to start investing to enter the market. It is true that one store of value that is appreciated thereby becomes more attractive.

Criptovalute

There is a lot to say on the subject, but it would be beyond the scope of this discussion. Recent declines have exposed the central vulnerability of these investment instruments: the lack of a solid underlying foundation. Whatever criptovaluta it can take on any value based on market demand - generally the supply is fixed or in any case grows very moderately -. You can invest in cryptocurrency as a means of speculation to be followed day by day in order to make a profit, but see them as a tool for saving in the long run it is really difficult.

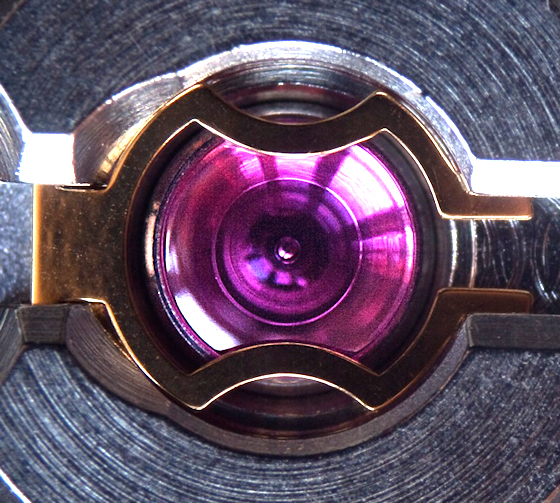

Luxury watches

Watch di luxury it has been a safe haven asset since relatively recent times. After the quartz crisis of the XNUMXs, it took two decades for luxury watches to be seen as first investment and then even speculative tools. There is no intrinsic value like in the case of gold, and this is evidenced by the fact that some Rolex they sell over the doppio of the price di list - a figure that represents the value of the object estimated by the same manufacturer -, just as it is possible to find complicated ones, even from prestigious brands, out of fashion in terms of size or aesthetics, at low prices.

That said, tracking overall trends in watchmaking doesn't seem impossible. The big brands - Rolex, Patek Philippe, Audemars Piguet - and their most famous pieces continue to increase in value over time. Although some price peaks, objectively difficult to justify, have recently been scaled back, the luxury watch remains a potentially very lucrative investment.

In the next article, we will see in which sectors of luxury watchmaking it may still be worth investing and we will delve into the topic of Rolex prices, which have recently undergone a small, but indicative, decline ...

Stay up to date on all the news from the watchmaking world by subscribing to the newsletter magazine di Chronosectby clicking at the bottom of the page!