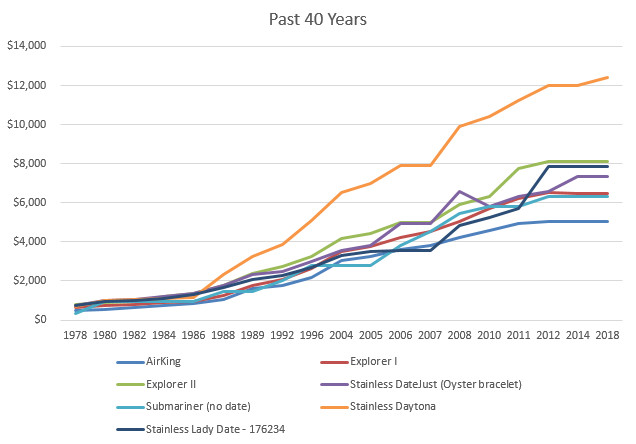

With the crisis economic caused by the restrictions implemented in the period covid, a strange phenomenon has occurred. Faced with the contraction of almost all commercial sectors - net of the "rebounds", however not such as to recover previous years -, the sector of the clock di luxury see one keep going, forte growth. To confirm this, just take a look at the prices of the most requested Rolex, the Daytona ...

What are the reasons for the liveliness of the market ofluxury watch? And it is destined to to last, this effervescence? Read on to find out.

The luxury watch: no crisis?

La economic crisis which has been holding tight to the whole West for two years now has affected the various social groups in different ways. The middle class was particularly damaged, as were those already living on the poverty line. But who had a high income, before the pandemic, it tends to continue to do well economically even today. Unlike what happened after 2001 September XNUMX, there was no perception that the watch market and, in general, that of luxury, risked collapsing.

La spending propensity of the western wealthy classes, together with the purchases of new rich from the Far East, led the luxury watches to be more and more in demand. Those who want to safeguard their assets and invest to increase it consider the luxury watch a "safe haven".

No crisis in view, therefore, for the luxury watch. Or not?

The luxury watch: possible problems

Il problem more about the Watches di luxury and their shortage. Of course, the fact that the production is limited, and the very high demand means that the number of clocks in circulation is rather small. This scarcity is compounded by the fact that many of the owners they hoard their watches, stockpiling them waiting for prices to rise further.

The risk, therefore, is that the luxury watches become too rare to continue to be "current currency". However, this risk is known to the manufacturers, who are the first to have an interest in not "pulling too hard" on exclusivity.

Investing in the luxury watch: the future possibilities

In recent months, the Chronosect certified traders we have been informed that the circulation of luxury watches may recover. This is thanks, on the one hand, to the restoration of the production lines in Switzerland, heavily impacted by the lockdowns last year. On the other hand, who has bought luxury watches as a reserve of value in the first phase of the lockdown is starting to want capitalize the investment. Attracted by prices in ascent, The Investors they could think of cashing in and, in so doing, make available the market their watches. Audemars Piguetmoreover, it has announced its intention to increase production next year, and it is not excluded that other manufacturers will do the same.

It is very difficult to predict the dynamics of a complex market like that of luxury, where emotional factors intersect with the choices of investment. However, we can note that, so far, i prices of luxury watches most requested, including Rolex and other prestigious brands like Audemars Piguet, Patek Philippe e Omega, they didn't do that to go up. And nothing suggests future changes ...