Dr. N.

We saw in the previous article how the luxury watch market could be affected by the ongoing economic crisis. The measures to stop production activities decided by many Western governments have put the middle class in great difficulty. How will we get out of this situation? What are the consequences on the luxury market in general and on watches in particular? Let's see it together in this second part.

The economic prospects

The scenario analyzed in the last article assumed Keynesian measures to support middle class incomes. Following these stimuli, the economy would pick up. These are solutions that have been tried and tested in the past and may still work, but they require political will to be implemented.

At this point we enter the imponderable: political decisions are human choices influenced by many factors. We cannot know what directions the governments of Italy and of the other countries of the European continent will take. However, we can trace hypothetical trajectories based on past choices and current legal conditions.

The first fact that we should take into consideration is that the Italian government has repeatedly expressed, especially through the mouth of the current Minister of Economy, the will to abide by the budget rules dictated by international treaties, including that of Maastricht and that of the Fiscal Compact, as early as 2021. The political data would therefore tend to exclude Keynesian-type maneuvers.

As for the economic data, ISTAT found, in September 2020, one deflation of the average 0.5% in Italy. This value indicates the presence of a situation in which wages are falling and consumption stagnating.

So what happens after a long period of non-perception of income and a decline in consumption? There is an impoverishment of the middle class. However, the ECB - like every other central bank in the West - continues to inject liquidity into the financial markets. This is a must to make the euro survive in the short term despite the weakening of the real economy. However, this liquidity does not reverberate in favor of the middle classes, but only the upper class, which, unable to invest in the production of wealth for the middle class (no one buys), will put its savings partly in further financial products, partly in goods traditionally considered as a store of value.

The governments of other European countries, although less rigid in the application of the budget criteria dictated by the European Union, do not seem willing to adopt Keynesian policies in the classical sense. Germany and France will support their strategic sectors, but without creating widespread demand by raising the incomes of the entire population.

Summing up, therefore, a situation arises in which the distribution of wealth in Western Europe persists in the trends seen in the last three decades: concentration of purchasing power in the highest segments of the population and widespread impoverishment of the middle class.

What are the consequences on the watch market?

The middle and lower-middle range of the watch market could be significantly affected by the decline in incomes of the majority of the population. Brands such as Hamilton, Longines, Tudor and even Cartier could be affected by this contraction. Let's hazard a prediction: the smartwatch market may no longer be expanding as it did until today.

Who, on the other hand, would benefit from the greater availability of income on the part of the upper sections of the population? Probably the most prestigious brands, such as Patek Philippe, Audemars Piguet, Rolex, omega, they will not see their sales decline. These maison however, they are already the object of the interest of collectors who buy for investment purposes, therefore it would not change much for them. Prices would probably increase of the watches of these major brands, both for new and used watches.

What about precious metals?

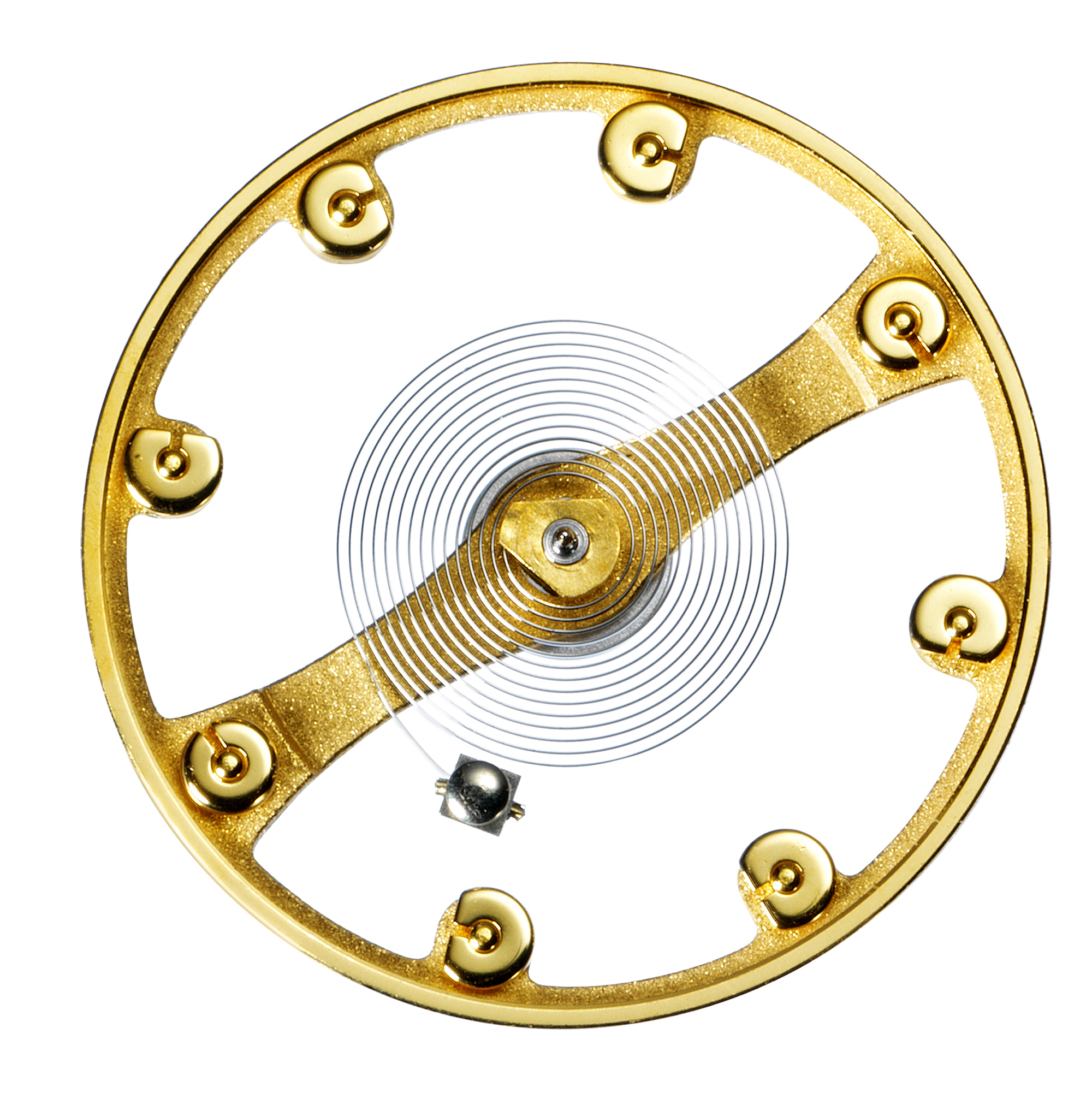

Gold and, to a lesser extent, silver, are and will remain highly interesting reserves of value. All human history sees these two metals and in particular gold as the means par excellence to which one turns when it is necessary to put aside reserves of value.

Over the course of 2020, the price of gold and silver rose. Of course, gold is very important to the stability of global financial systems and monetary authorities around the world are not likely to welcome its excessive appreciation against currencies. Therefore, interventions to "calm" the price of the yellow metal are always possible. That said, it is reasonable to expect that, due to sustained demand and limited production, its price will increase. We have already said about the question: it should come above all from subjects of high economic class. On the supply side, it is necessary to underline that two of the world's largest producers, China and Russia, have not exported gold for years, preferring to store what they extract in state reserves. This move actually leaves only Australia, Canada and the United States as producers for a market that is increasingly under pressure. For this reason it seems reasonable to think that the price of gold will gradually continue to rise in the near future.

(The price of gold in euros, in the last year. Source: Il Sole 24 Ore)

Conclusions

In these two articles of ours we have tried to outline the salient lines of the macroeconomic picture in the West and its impact on the luxury market, especially of luxury watches. Two scenarios resulted.

In the first, the crisis underway due to the restrictive measures taken following the spread of Coronavirus is responded to with Keynesian choices: deficit public spending aimed at guaranteeing full employment. The consequence on the luxury market would be a return to the years of the First Republic, when the Italian watch market was the strongest in the world after the US. All watch bands would benefit, especially the medium and medium-high ones.

In the second scenario, government policies remain those seen up to now: central banks inject liquidity into financial systems and states pursue budgetary choices aimed at balancing. This means recession or stagnation for the middle class and increased wealth for the upper classes. The consequence for the watch market would be an appreciation of the most prestigious brands such as Patek Philippe, Audemars Piguet, Rolex, Omega.

We believe the second scenario to be more probable, due to the behavior so far held by Italian and European political decision makers.

And you, what do you think of the consequences of the crisis that followed Coronavirus on the market of luxury watches? Tell us in the comments!

If you liked this article, subscribe to the Chronosect Newsletter (at the bottom of the home page) and read our Shops!

Disclaimer

This article is written for informational purposes only and is not intended to provide financial or investment advice. Always contact competent subjects for your investments. We decline any responsibility for the investment advice that the reader may wish to draw from this article. The information contained herein should not be considered a solicitation to the public for savings or the promotion of any form of investment, nor personalized recommendations pursuant to the Consolidated Law on Finance, since it is only standardized information addressed to the indistinct public.